how to prepare financial reports easily

August 24, 2022

How can beginners learn money investing techniques?

January 2, 2023Interested in finding out a top widely used financial planning tools that is currently available? Financial planning tools are software applications that help individuals and businesses track income, expenditures, investments, and cash flow. Budgeting is one of the most important things you can do to improve your financial health. It allows you to see where your money is going, find ways to save money and make sure you are spending within your means.

There are many financial planning tools available, but not all of them are created equal. Some are more user-friendly than others. Some have more features than others. Some are simply superior to others. So, which tool is the best? That’s a tough question to answer because it depends on your individual needs and preferences. But we’ve done our research and compiled a list of a top widely used financial planning tools.

Why financial tools are necessary?

Budgeting is important because it helps you understand where your money is going. Financial tools can be helpful because they make it easy to track your spending and see where you can save money. They can also help you stay on track by providing reminders and notifications when you are close to overspending.

It’s an essential task to set a budget for yourself, no matter how much money you make. A budget will help you make better financial decisions, stay out of debt, and save money.

10 best A top widely used financial planning tools

We have provided the 10 best financial tools for budgeting in 2022 and they are the top widely used financial planning tools. Read on to find out which one

1. YNAB

You Need a Budget, popularly known as YNAB, is a comprehensive financial planning tool that can be used for various purposes such as long-term planning, short-term budgeting, and tracking your net worth. It offers several features such as goal setting, debt payoff plans, tracking investments, etc. The app also provides detailed reports and analysis to help you understand your spending patterns and take necessary actions accordingly.

Overall, YNAB is one of the most popular and best budgeting apps available currently. Hence, it is rightfully included in the list of the top widely used financial planning tools for 2022.

Main Features of YNAB

Connect to Your Bank

Securely link your accounts and import transactions automatically.

Goal Tracking

Prioritize spending and savings goals with our powerful target-setting features and track your progress at a glance.

Loan Calculator

Find more money for your debt with YNAB’s loan planner tool. We’ll calculate the interest and time saved for every extra dollar you put toward debt.

Spending & Net Worth Reports

Eye candy (read: graphs and charts) make it fun to obsess over your progress. See your average grocery spend (down to the cent) and your growing wealth in full Technicolor glory.

2. Mint

Mint is another comprehensive budgeting and financial management app that offers a plethora of features. Some of the key features offered by Mint include creating a budget, tracking spending, monitoring bank accounts and investments, receiving bill reminders, etc.

Mint also provides personalized tips and advice based on your financial data to help you make better financial decisions. It connects to your bank account and credit card to automatically track your transactions. You can also manually add transactions. Overall, Mint is an excellent financial planning tool and is suitable for both novice and experienced users.

Main Features of MINT

No need for multiple apps

Easily connect all your accounts. From cash and credit to loans and investments, you can see your complete financial picture in Mint.

Track your cash flow with ease

We help you stay on top of your accounts, bills, and subscriptions. Get notified when your subscription costs increase and when bills are due.

Save smarter with custom budgets

Start saving more today. Easily create your budget in Mint. We’ll automatically categorize your transactions, so you don’t have to.

Achieve more with Mindsights™

Get personalized insights to spend smarter, save more, and pay down debt. We track your net worth, spending, and budget to find opportunities.

3. EveryDollar

EveryDollar is a budgeting app created by the team behind Dave Ramsey, a popular financial expert, and author. The app is based on Ramsey’s “Zero-based budgeting” method and follows a simple approach to budgeting.

EveryDollar allows users to create a budget by allocating every dollar of their income to specific expenses. This makes it easy to track where your money is going and helps you stay within your budget. EveryDollar is an excellent financial planning tool for those who want to follow the zero-based budgeting method.

4. Goodbudget

Goodbudget is another popular financial planning tool that follows the envelope budgeting method. The app allows users to create virtual envelopes for different expenses and allocate funds to them accordingly. This makes it easy to track your spending and stay within your budget. Goodbudget also offers features such as tracking investments, monitoring bank accounts, etc. You can also share your budget with a partner or family member and work together to manage your finances. Overall, Goodbudget is a great financial planning tool for everyone across the globe.

5. Mvelopes

Mvelopes is a financial planning tool that follows the envelope budgeting method. The app allows users to create virtual envelopes for different expenses and allocate funds to them accordingly. This makes it easy to track your spending and stay within your budget. Mvelopes also offers features such as tracking investments, monitoring bank accounts, etc. Mvelopes is an excellent budgeting app for those who want to follow the envelope budgeting method.

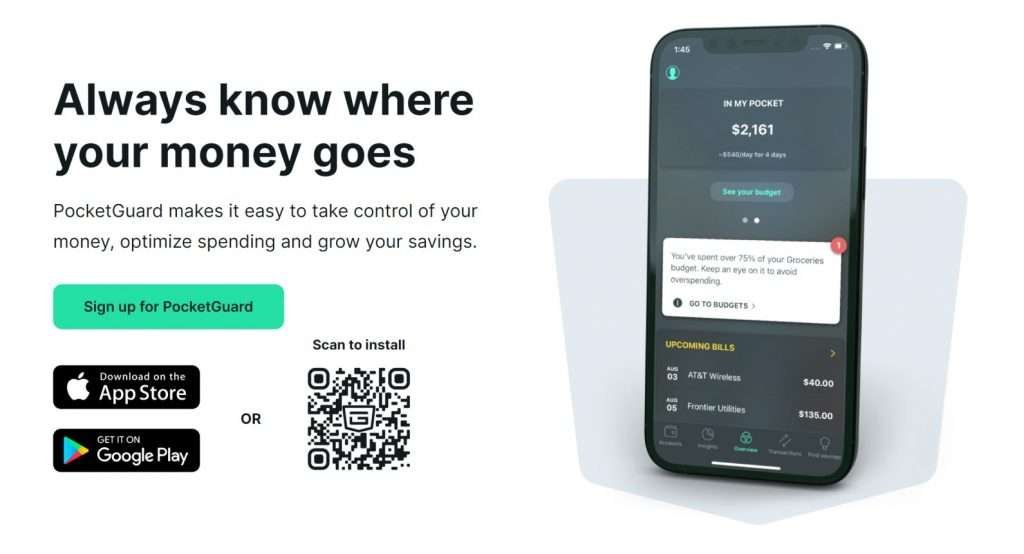

6. PocketGuard

PocketGuard is a relatively new entrant in the world of financial planning tools, but it has quickly gained popularity due to its simple and effective approach to budgeting. The app tracks your income and expenses and provides insightful reports to help you understand your spending patterns. PocketGuard also allows you to create a budget and set spending limits for different categories.

7. Personal Capital

Personal Capital is a financial planning tool that can be used on both iPhone and Android devices. It links to your bank account and automatically categorizes your spending.

After you have linked your account, the app will begin categorizing your spending. You can see all of your spending in one place, and you can even create a budget within the app. If you want to track your investments, Personal Capital has a great investment tracker. You can see all of your investment information in one place, and you can even set up alerts so that you are notified when your investments change.

8. Stash

Stash is an app that helps you budget better by tracking your spending, setting goals, and helping you save money. It’s great for people who are trying to get their finances in order and need a little help staying on track. Stash tracks your spending so you can see where your money is going and where you could save. It sets goals so you can stay on track with your finances and make progress toward your financial goals. It helps you save money by giving you tips on how to cut costs and make the most of your budget.

Is stash a reliable app for budgeting?

Yes, Stash is a reliable budgeting app. It has been featured in numerous publications, including The New York Times, Wall Street Journal, and Time Magazine. It has also been downloaded over 500,000 times from the App Store.

9. Wally

Wally is a comprehensive budgeting and financial management app that offers several features such as creating a budget, tracking spending, monitoring bank accounts and investments, receiving bill reminders, etc. It also provides insightful reports and analyses based on your financial data to help you understand your spending patterns and take necessary actions accordingly.

Wally is a great budgeting app for people who want to get a better handle on their finances. It’s simple to use and provides users with a clear picture of where their money is going. Wally also allows users to set up goals and track their progress over time.

10. Spendee

Spendee is a comprehensive financial planning tool that offers several features such as creating a budget, tracking spending, monitoring bank accounts and investments, receiving bill reminders, etc. It also provides insightful reports and analyses based on your financial data to help you understand your spending patterns and take necessary actions accordingly. Spendee is an excellent budgeting app and is suitable for both novice and experienced users.

What are the benefits of financial planning tools?

Financial planning tools can help you in several ways. They can track your spending, help you save money, and even give you tips on how to improve your finances.

Tracking your spending

A financial planning tool can track your spending so you can see where your money is going each month. This information can be very helpful in identifying areas where you may be able to save money.

and finally, you can learn more about how to save money and manage your budget easily with our knowledge articles.

Ways to Save Money on a Tight Budget

It is very Challenge to Save money on a tight budget, but don’t worry we will walk through this article step by step.